WhatsApp)

WhatsApp)

The mineral industry provides a major source of economic growth in Peru''s national development. In 2006, Peru occupied a leading position in the global production of the following mineral commodities: fourth in arsenic xide, third in bismuth, third in copper, fifth in gold, fourth in lead, fourth in molybdenum, fourth in rhenium, first in silver, third in tin, and third in zinc.

Export procedures. Export means to take or cause goods to be taken out of partner states. Exports are free of duty and taxes except for three items; Raw hides and skins which are chargeable to export levy at the rate of 80% of FOB value or USD per kg whichever is greater, Raw cashew nuts which are chargeable to export levy at the rate of 15% of FOB value or USD 160 per metric ton ...

Tariffs and Import Fees What is a tariff? A tariff or duty (the words are used interchangeably) is a tax levied by governments on the value including freight and insurance of imported products. Different tariffs are applied on different products by different countries.

China offers 9% export tax rebate on steel productsMetals Mining export tax mining products, Jun8 MetalBizChina is offering a 9% valueadded tax rebate on exports of several high, China offers 9% export tax rebate on steel productsEXIMgov The ExportImport Bank has a variety of flexible products that are designed to meet your specific needs

Philippines Taxation ... including mining and petroleum taxes, residence taxes, a head tax on immigrants above a certain age and staying beyond a certain period, document stamp taxes, donor (gift) taxes, estate taxes, and capital gains taxes. ... how much is the tax for import or export machine?example the machine come from brasil... 19. shiemz.

Doing business in Ecuador: Ecuador trade and export guide ... handling material equipment and mining tools; health and safety products and services ... Ecuador has a service tax that applies to ...

Using data mining on data about imports and exports can help to detect tax avoidance and money laundering. False. ... In data mining, finding an affinity of two products to be commonly together in a shopping cart is known as A) cluster analysis. B) decision trees. C) artificial neural networks.

USA Customs Import and Export Duty Calculator. Goodada''s USA customs import and export duty calculator will help you identify the export tariff rates you will pay for the USA. By providing our team of brokers with several pieces of key information, we can determine the rates due and assist you in clearing the products.

Get an Export License or Permit. Most items exported to a foreign buyer will not require an export license. However, all items are subject to export control laws and regulations. The best way to find out if an item requires an export license is by checking which agency has jurisdiction over, or regulates, the item you are trying to export.

Malaysia Trade Regulations and Standards. The leading certification, inspection and testing body in Malaysia is Sirim QAS, a subsidiary of SIRIM Bhd. SIRIM Berhad, formerly known as the Standards and Industrial Research Institute of Malaysia, is the governmentowned company providing institutional and technical infrastructure for the also provides marks for a variety of ...

Find out how UK companies can control risks when doing business in Ethiopia. Export opportunities and advice Find more export advice and explore opportunities overseas on

Doing business in Mongolia: Mongolia trade and export guide ... over 72% and open to new products, services, and ideas ... Mongolia does not impose export taxes. China has provided a ready ...

Export permits and restrictions. Export controls and requirements, certificates and permits, excise taxes, sanctions and prohibited goods. International research and development network. Accessing industrial technologies, expertise, funding and markets in Europe and beyond through EUREKA.

The economy of Andorra is a developed and free market economy driven by finance, retail, and tourism. The country''s gross domestic product (GDP) was US billion in 2007. Attractive for shoppers from France and Spain as a free port, Andorra also has developed active summer and winter tourist resorts. With some 270 hotels and 400 restaurants ...

Most imports (93% of codes) are also subject to an 18% value added tax (VAT), as are domestically produced goods. In addition, an excise tax (ISC) is applied to certain products such as tobacco and alcoholic beverages. There are no quantitative import restrictions.

Export restrictions of raw materials are also used to meet other objectives; for example, to generate revenue for the government, to control the export of illegally mined products, to enhance environmental protection, or to offset exchange rate impacts caused by exports of several commodities.

provide excise tax agents with specific tools to examine issues relating to domestic produced coal. The guide provides guidance on 13 potential audit issues, general audit guidelines, sample IDR requests, a glossary of mining terms, and includes background information on the coal mining industry.

Exports from Indonesia dropped percent from a year earlier to USD billion in October 2019, better than market consensus of an percent decline and after a marginally revised percent fall in the prior month. Oil and gas exports slumped by percent to USD billion on the back of mining products ( percent), including crude oil ( percent) and natural gas ...

Congo, Democratic Republic Mining and MineralsCongo (DR) Mining and Minerals This is a best prospect industry sector for this country. Includes a market overview and trade data.

Goodada Helping South African Importers and Exporters with their Duty Taxes. Most goods imported or exported are subject to South African Customs Duties. A complete import and export declaration form must be completed which our South Africa Customs Broker can assist you with.

Argentina imposes temporary tax on exports Decree No. 793/2018 reflects "emergency measures" (as announced by the president on 3 September 2018) and imposes a 12% export tax (customs duty) on all goods exported from Argentina. The new tax will be effective 1 January 2019, and will apply as a "temporary measure" until 31 December 2020.

The economy of Nauru is tiny, based on a population in 2014 of only 11,000 people. The economy is primarily based on phosphate mining, offshore banking, and processing of coconut of phosphate ceased after the exhaustion of the primary phosphate reserves, but in 2006–07 mining of a deeper layer of "secondary phosphate" began.

Artisanal mining, predominantly of gold and diamonds, takes place in parts of Liberia. Artisanal miningtraditionally carried out primarily by unlicensed and illegal minerscontributes to the country''s economy through royalties and taxes paid by licensed dealers. A minority of artisanal miners hold smallscale mining licenses.

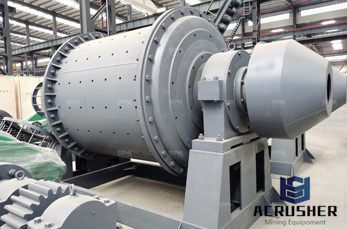

Zero rate on mining products for export; Please note that there is also a 30 percent corporate tax for mining. Incentives for Agriculture. Agriculture companies have the following specific incentives: Dividends payable to farmers are tax exempt for the first 5 years of operation; Fifteen (15) percent income tax on farming profits

WhatsApp)

WhatsApp)