WhatsApp)

WhatsApp)

The Ministry makes a commitment to provide a service to the specified quality standards and within stated time limits. Mining in Zimbabwe. Zimbabwe''s mining industry is focussed on a diverse range of small to medium mining operations. The most important minerals produced by Zimbabwe include gold, asbestos, chromite, coal and base metals. ...

Question How long does it take for ZIMRA to give a refund if one is entitled to one? Answer. Where no issues have been noted after risk profiling in respect of the refund ZIMRA is supposed to make a VAT refund within 60 days from date of submission of the return.

Construction Industry Federation of Zimbabwe (no translation found) 2012 Construction, technical consultancy ... activities where undertaken by an employer in the mining industry in association with his ordinary employees in the mining industry where such work is undertaken on a mining location or special grant as defined in the Mines and ...

National Employment Council Of The Mining Industry Phone and Map of Address: Harare, Zimbabwe, Zimbabwe, Business Reviews, Consumer Complaints and Ratings for Councils in Zimbabwe.

Title. SI No. 2016. Date. Commissions of Inquiry Act: Commission of Inquiry into Conversion of Pensions and Insurance Values from Zimbabwe Dollars to US Dollars: Amendment of .

ALEX MHEMBERE PRESIDENT CHAMBER OF MINES OF ZIMBABWE. PRESENTATION OUTLINE 1. GEOLOGICAL POTENTIAL A Brief Overview of the Mining Industry in Zimbabwe 2. LEGAL FRAMEWORK ... • The gold mining sector is currently operating at 50% of potential capacity utilisation.

The Chamber of Mines of Zimbabwe (COMZ) is a private sector voluntary organization established in 1939 by an Act of Parliament. The members include mining companies, suppliers of machinery, spare parts, and chemicals, service providers including banks, insurance companies, consulting engineers, and various mining related professional bodies and ...

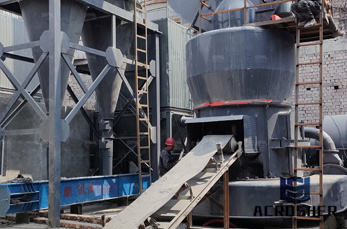

minimum operating standards for mining industries in zimbabwe. minimum operating standards for mining industries in zimbabwe Zimbabwe has satisfied the minimum requirements of the, Minimum Operating Standards For Mining Industries In Zimbabwe liberation mining lubimbi Live Chat; THE MINERAL INDUSTRIES OF A FRICA USGS

management of mining, quarrying and oreprocessing waste in the European Union. This project was completed mainly through the use of questionnaire sent to subcontractors in almost each country of the EU. To assess this information and to extrapolate to the next twenty years, this approach has been reinforced using published

this impact existing agreements with mining companies in Zambia in terms of the economic viability of any particular project or operation. The State of Mining in Africa Striking a balance, is a consolidated point of view of the Deloitte mining leaders across Africa backed by research. We have taken a snapshot view of several mining

The following are companies listed on the Zimbabwe Stock Exchange (ZSE, )

prominent role in mining, particularly in the resettlement of their subjects. The Zambian government is pursuing an economic diversification program to reduce its reliance on the copper industry. An agreement on rail cooperation between South Africa, Zambia, Zimbabwe and the Democratic Republic of Congo (DRC) allowing copper rich

2012 Americas School of Mines Basics of US Mining Accounting Christie GreveSenior AssociateAlex MayberrySenior AssociateMolly Hepburn Manager Benita Pulins Managing Director

Financial Reporting in the Global Mining Industry A survey of twentyone leading companies. Managing Risk in the Global Mining Industry Mining for the Best Report IASC Extractive Industries Issues Paper Comprehensive Integrated ... the International Accounting Standards Committee published "Extractive Industries,

Occupational health and safety problems among workers in the wood processing industries in Mutare, Zimbabwe Steven Jerie Department of Geography and Environmental Studies, Midlands State University, Zimbabwe. ... in the mining, industrial and agricultural sectors.

PwC Corporate income taxes, mining royalties and other mining taxes—2012 update 3 as "ring fencing". The Ghana government, in the 2012 Budget Statement, proposed an increase to the corporate income tax rate from 25% to 35% and an additional tax of 10% on mining companies. Ghana''s proposed tax increases are likely to take

HARARE: Zimbabwe will tighten requirements for companies seeking licenses to mine in the country''s Hwange coal belt in order to protect the environment, mines minister Walter Chidhakwa said on ...

Mining Contact us TAXATION IN ZIMBABWE Taxation in Zimbabwe is source based and has not changed to residency based system as had been discussed during the course of the year. Therefore all income that accrues or is deemed to have accrued in Zimbabwe is taxed in Zimbabwe. The tax year in Zimbabwe runs from 1 January to 31 December.

African Federation for Construction Contractors Association (AFCCA) was formed in 2006 in Cairo, Egypt for the purpose of creating and developing the professional ties .

Apr 17, 2017· Gold rush fever among poor Zimbabweans leaves trail of destruction ... artisanal gold miners were operating in the country. ... the government cannot legalise gold mining in the area. The ...

Minimum Operating Standards For Mining Industries In Zimbabwe. Zimbabwe Leads Safe Mining Practice Legislation in Africa, Zimbabwe has taken one step closer to becoming a leader among African nations with their stance on mine safety and minimum standards for the provision of safe working conditions for the local underground mining industry

Zimbabwe has 2 laws that govern company and business registrations. These are the Companies Act (for Private Limited Companies) and the Private Business Corporations Act (for Private Business Corporations). This article gives the requirements for company registration under these 2 types of companies.

A company is resident in Zimbabwe (Zim) if it is incorporated, formed or established in Zim or has its place of effective management (day to day management) in Zim. Zimbabwean resident companies and private business corporations (companies) are taxed on nonexempt income from a source within or deemed to be within Zim. Income from a

Dec 14, 2018· Some companies during the past decade have folded never to come back, some struggling but without measuring all of them with the same yardstick, some have managed to thrive, posting the best results financially and in production terms. Mining Zimbabwe however took time to go through the performance of various companies in a list of 10.

WhatsApp)

WhatsApp)